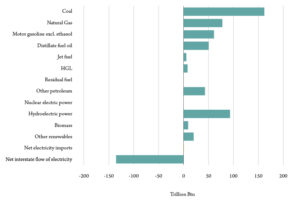

As our nation continues to move toward energy independence, with strong energy-enabled manufacturing, lower energy intensity, progress on greenhouse gas emissions and reduced consumer costs, Montana also has good energy news – but it is tempered by a bit of reality.

The Treasure State has oil, coal, hydro and wind resources that rank high among states. Oil and coal development and production contributed nearly $200 million to the budgets of state, county and local governments in fiscal year 2018 (Montana Department of Revenue). We have relatively low electricity prices, primarily because of our hydropower and coal-fired generation and their proximity. In fact, according to the U.S. Energy Information Administration (EIA) in August 2018, Montana’s average residential electricity cost was 35th in the nation at 11.51 cents per kilowatt-hour – Hawaii ranked first at 32.40 cents/kWh and California fifth at 20.56 cents/kWh.

There has been movement toward more use of renewable sources among the state’s diverse energy mix, and Montana’s energy investment climate shows signs of improvement.

Montanans, however, are still among those using more energy per capita than consumers in most other states. We also spend more per person on our energy overall. In the EIA’s latest full reporting year data for 2016, Montana ranked 15th in total energy consumption per capita and 14th in total energy expenditures per capita. Factors such as cold winters and long driving distances undoubtedly contribute to these trends. Other factors also provide reasons for caution when trying to gauge Montana’s energy future.

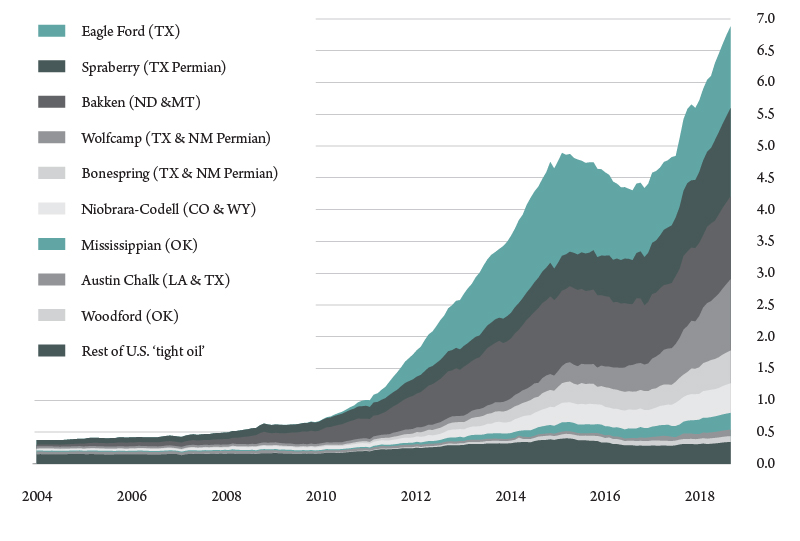

Stunning technology advancements underpin a new, exciting phase of the shale energy revolution that is pushing the U.S. toward energy independence and oil and gas exports unimaginable only a few years ago.

The Bakken play in North Dakota and Montana has been part of the revolution. New exploration, development and production efficiency gains are surprising even to those accomplishing them. Increased precision in drilling and hydraulic fracturing, with use of high-tech downhole sensors, fiber optic communication, continuous remote monitoring, and real-time process adjustments, are improving flow rates and lowering costs dramatically nationwide.

Even older oil producing areas of Montana are benefiting from technology application. Most striking for the future will be the injection of carbon dioxide into oil-bearing formations to sweep otherwise unrecoverable crude to producing wells.

A number of significant oil and gas companies in all sectors – exploration and production, gathering and pipelines, and refining – remain strong participants in Montana’s energy economy. They and others see the state as one of the better places to do business.

We are seeing an uptick in oil and gas permitting by the Montana Board of Oil and Gas. Fifty-nine new-well permits were issued in roughly the first 11 months of 2018, compared with 35 for all of 2017 (Montana Board of Oil and Gas, 2018). But prices still matter. In the near term, prices may remain lower and more volatile than companies need to fund all their multimillion-dollar projects in new shale-related or enhanced oil recovery projects.

Employment patterns in oil and gas will continue to change. As we’ve said for several years, the old boom and bust well-driven cycles of decades past have been replaced with resource and technology plays, such as the Bakken. Today there’s more stability once initial exploration and early development has occurred. The process has become one of replicating and tweaking – almost in a manufacturing sense.

New technology, data and communication-driven efficiencies in shale-related projects are potentially leading to the need for fewer, more skilled, workers than before. In places like Sidney in eastern Montana’s Bakken, that also support activity in North Dakota, stability seems to be the new norm. Elementary school enrollment is steady, and housing prices have started to return toward levels seen before the big boom.

Perhaps the greatest uncertainty in Montana’s energy future is in the coal industry. Coal currently fuels about half of Montana’s electrical generation. But there has been a general decline in coal demand in the U.S., with plant closures tied to environmental concerns and natural gas competition.

The expected closure within the next several years of the oldest pair of units at the four-unit Colstrip Electric Generating Station, and the pending bankruptcy of Westmoreland Coal, the owner of the Rosebud Mine that supplies Colstrip, contributes to that uncertainty.

Yet, there are early indications of some changing coal dynamics. Montana coal production increased in 2018. In December, it was on pace to reach 38 million tons or 3 million tons more than in 2017. The reason could be a higher demand for coal elsewhere in the world.

The global demand for coal has been growing, with Asian nations leading the demand growth. Lacking energy diversity, coal-generating plants are still their lowest-cost option for power. Even if demand plateaus, Montana’s Powder River Basin coal is best-suited for new, high-tech plants designed to run efficiently with lower CO2 emissions.

It would seem there is ample Montana mine capacity to meet an increase in export demand. Production in the state peaked at some 44.9 million tons in 2008, according to the Montana Coal Council. It could reach that level again if the demand is there. However, meeting increasing international demand for Montana’s coal will depend in large measure on export terminal capacity on the West Coast.

Several ports or port expansions have been denied by states, leaving only one such project pending – the Millennium Bulk Terminal project on the Columbia River in Longview, Washington. Its proponents are continuing to battle the State of Washington for permits to modernize and expand the site of a former aluminum smelter and existing port facility. This could lead to a Supreme Court decision on the question of how far a state may go in preventing interstate – or international – commerce. Meanwhile, Montana’s coal exports must be railed to British Columbia for shipment.

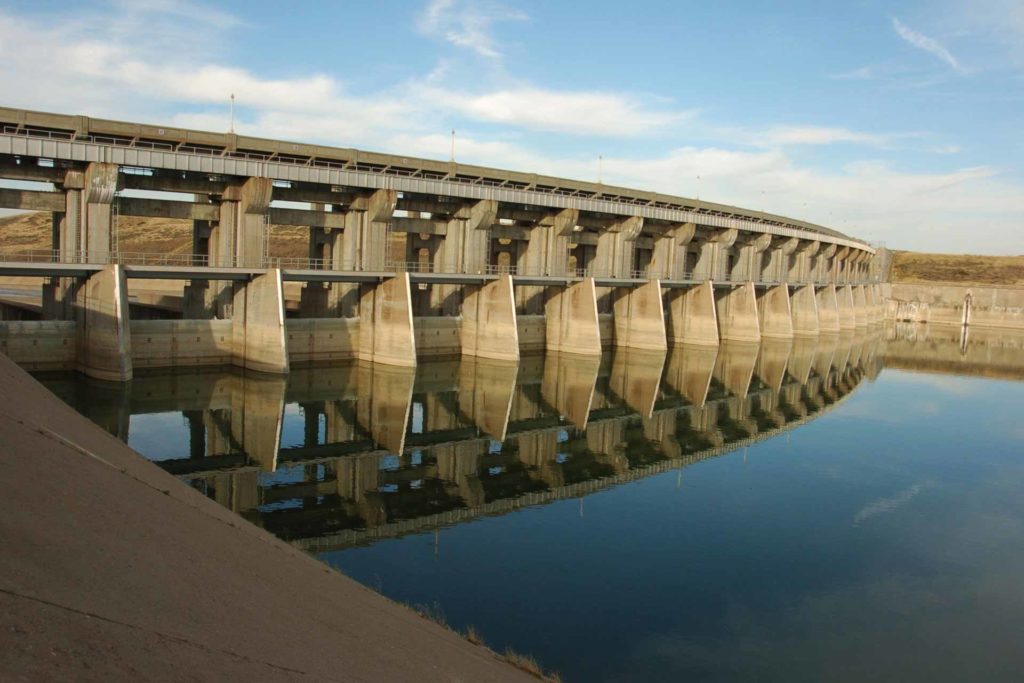

Finally, Montana has significant resources and future potential in renewable energy. Most significant perhaps are our hydropower resources and operations – Montana is fifth among states producing hydropower, and 23 dams provide almost 40 percent of Montana’s electricity generation.

Wind energy capacity has been growing, and windmill generators are providing some 8 percent of the state’s power generation. Whether that share will grow is dependent on wind power’s intermittent nature and the state’s electricity export transmission capacity. The state’s wind power capacity factor (the percentage of total wind generation capacity that is actually available) averages 30 to 40 percent and can vary by season and even time of day.

This situation can cause significant challenges for integrating renewables into Montana’s energy mix. Solutions like large-scale battery and pumped hydro storage are in the works. The state’s utilities and cooperatives continue to seek improvements to systems and processes to ensure reliability of power and reasonable consumer costs. In addition, small “microgrids” and off-grid power will be part of Montana’s energy future.

The bottom line for Montanans is that we are energy-blessed in many respects. But no source is perfect, and some challenges persist.

References

Montana Department of Revenue Statewide Accounting, Budgeting, and Human Resource System” (SABHRS), December 12, 2018.

Montana Board of Oil and Gas. December 3, 2018.