What would the economy of the state of Montana look like if the eight largest hard rock mines – producing copper, palladium, gold, talc, cement and other products and materials – did not exist? That was a question posed in a recent study produced by the Bureau of Business and Economic Research. It addressed – both for existing and for proposed new metal mines – the contributions made by hard rock mining to jobs, income, spending, tax receipts and population in the state.

The conclusion underscored the continuing importance of hard rock mining activities, not only to the economic livelihoods of the communities that are home to the mining operations, but also to the health of the state economy as a whole.

Last year, Montana’s general fund revenues were extraordinarily weak. General fund collections – encompassing the entire suite of state taxes and fees not earmarked for specific use – managed to grow by just $20 million in 2017. On a base of $2.1 billion, that was roughly a tenth of a percentage point growth. The question was why these revenues were not coming in as they should have been?

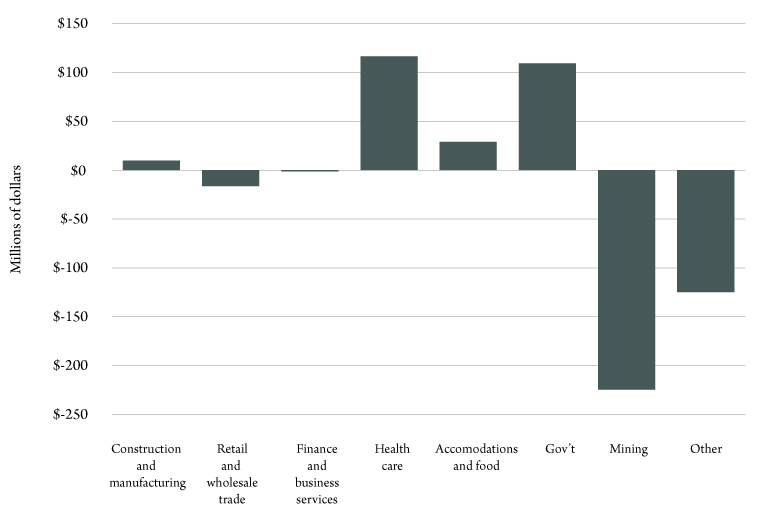

Now with a complete accounting of the patterns of growth in Montana’s economy, we see that a contraction in mining earnings of $225 million ultimately produced the worst revenue performance the state had seen since the end of the Great Recession (Figure 1). In truth, Montana’s hard times in mining in 2016 pertained more to oil and gas activities in the wake of the oil price bust – these were included in the mining total. But the essential message, that events in high earnings natural resource industries have a disproportionate impact on the economy as a whole, was demonstrated dramatically.

The mining industry and the state economy enjoyed a much better year in 2017. But an understanding of how the mining industry – and in the case of this analysis, the hard rock mining industry – can exert such influence on economic outcomes clearly is important.

Research Approach

There are at least three ways to approach the assessment of hard rock mining’s importance to the economy. Certainly, the products produced by Montana’s metal and talc mines – the palladium that goes into catalytic converters, the gold that is part of high-tech devices and the copper that goes into almost every electronic device – are of high value in a modern economy. Montana’s hard rock mines are also an important employer and customer for Montana vendors in the communities in which they operate. Lastly, there is the outsized contribution of hard rock mining to state and local taxation, thanks to Montana’s reliance on natural resource industries as part of its revenue base.

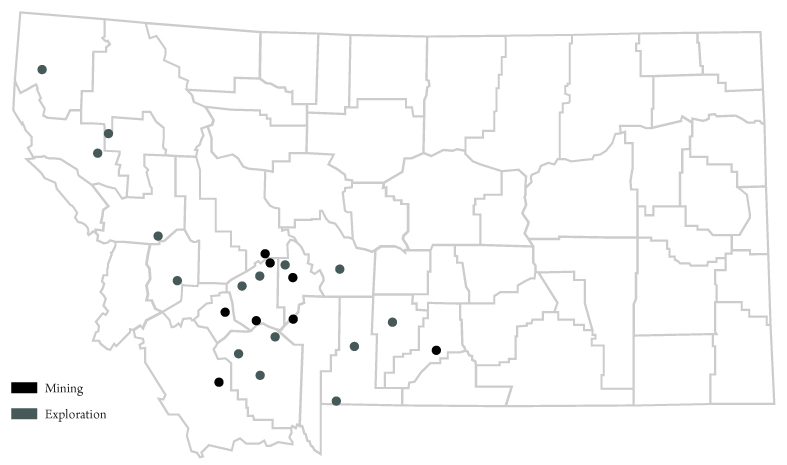

Using comprehensive information gathered from the state’s eight largest mining facilities on the breadth and scale of their operations, as well as the activities of the dozens of exploration projects currently underway throughout the state, we constructed a picture of what economic activity across the state would look like if those operations did not exist. Such a picture removes not just the mining activities themselves, but the transportation, energy, engineering and other activities that are closely linked to mining production, as well as the spending and activity in the economy as a whole that are induced by the mining companies and their employees.

In order to capture all of the interactions between hard rock mining and the rest of the economy, the study utilized a well-respected economic model (REMI), which was specifically calibrated for application to the Montana economy. The model provided the means to track and tally how the spending at Montana’s hard rock mines – by both workers who are employed there, as well as the mines themselves – supports other economic activity around the state.

The research compared two states of the Montana economy. The first is the directly observable activity of the economy as it exists today, which includes all of the impacts of Montana’s hard rock mining operations. The second economy is artificial – a “no mining” economy where the spending, production and jobs at Montana hard rock mines, including the ongoing exploration activities, are removed from the economy. The model was used to create this scenario, where the state economy comes to rest at a new, lower level of activity as the absence of mining is felt across all industries and activities. The difference between these two scenarios is the economic contribution of hard rock mining.

Montana’s Hard Rock Mines

The study considered the economic activity at eight specific hard rock mining facilities located around the state (Figure 2). Those facilities mine and process a variety of metals and other products, including copper, cement, talc, platinum, palladium, molybdenum and gold. Jointly these facilities directly employ more than 3,100 workers with annual wages in excess of $300 million. Additionally, the ongoing exploration activities that are underway across the state account for an addition $37 million each year in economic activity. In addition to these considerable wages, the hard rock mines also make considerable purchases of equipment and services from vendors and suppliers.

Natural resource industries, especially hard rock metal mines, have special importance for state and local tax revenues. Not including the taxes levied on workers, which are the same as other employers, the hard rock facilities analyzed in the study pay:

- Metal Mines Tax

- Resource Indemnity and Groundwater Taxes

- Cement and Gypsum Taxes

- State Lands Fees

- State Lands Royalties

- Property Tax – Net Proceeds

- Property Tax – Gross Proceeds

- Property Tax – Other

- Corporation Income Tax

With the major exception of property taxes, these taxes are remitted to state government. In fiscal year 2018, tax revenues from the taxes listed above (omitting the Corporation Income Tax) totaled $44.8 million.

Research Results

The analysis is quite detailed, but the answers to the basic research questions are simple. The Montana hard rock mining industry is an important source of prosperity and value to Montana households, businesses and governments – not just in the mining communities, but throughout the state. The state’s eight largest hard rock mining, talc mining and cement materials facilities together, with the ongoing exploration activities, ultimately produce a state economy that:

- has 12,304 more permanent, year-round jobs with average annual earnings of $86,030 per job;

- produces an additional $2.7 billion each year in economic output;

- sees Montana households receive $1.1 billion more per year in income, including $1 billion in after-tax income available for spending in their local communities;

- helps state government realize almost $200 million in additional tax and nontax revenue per year; and

- supports a population that is larger by 20,293 people, including 4,933 more school-aged children.

These economic contributions are well in excess of the employment, production and tax receipts produced by the industry directly, and reflect: 1) the extensive linkages that exist between Montana’s mines and the rest of the economy; 2) the high value-added nature of hard rock mining and the resultant high levels of capital expenditure and worker wages; and 3) the outsized contributions of natural resource industries in general, and the hard rock mining industry in particular, to Montana state government’s revenue mix.

The hard rock mining industry in Montana is an important source of jobs, income, sales revenue and tax revenue for Montana workers, households, businesses and governments. The eight largest producers of metals, talc, and concrete products today ultimately support more than 12,000 jobs statewide, with average annual earnings of more than $86,030. Many of those jobs are in smaller towns and rural communities with few, if any, opportunities in other industries for those workers and their families

Montana’s raw materials have tremendous value in the global marketplace. The process of finding, extracting and processing those materials, and ultimately turning them into the wide spectrum of products that improve our lives, is a chain of events that begins here and ends up all around the world.