There was no escape from the ravages of the COVID-19 recession across the landscape of Montana’s regions in 2020. High-flying areas of the state and more slowly growing areas alike suffered astounding job losses during the spring of that year. Yet the surprise of that sudden and severe downturn has been closely followed by a vigorous economic recovery that contained its own surprises. Among these were superheated housing markets, significant price inflation and a surge in consumer spending. And through it all, the divergence in patterns of growth across Montana regions has resumed.

From a national perspective, there have been winners and losers in this economic recovery, and those outcomes potentially matter for individual Montana communities. Broadly speaking, this has been a recovery that has seen shifts in consumer spending patterns, continued disruptions in global commerce, decreased appeal of living in large cities and accelerated adoption of technology. And like any other time in our economic history, it has seen some industries outperform others.

Some disruptions were positive for regions of Montana. While international travel got off its deadbed in 2021, the real or perceived difficulties of flying overseas redirected visitors to domestic venues. Huge visitor volumes at Montana’s two large national parks poured spending into the adjacent counties of Flathead and Gallatin. And the increased national appetite for housing in less densely populated areas has brought plenty of out-of-state buyers into local housing markets.

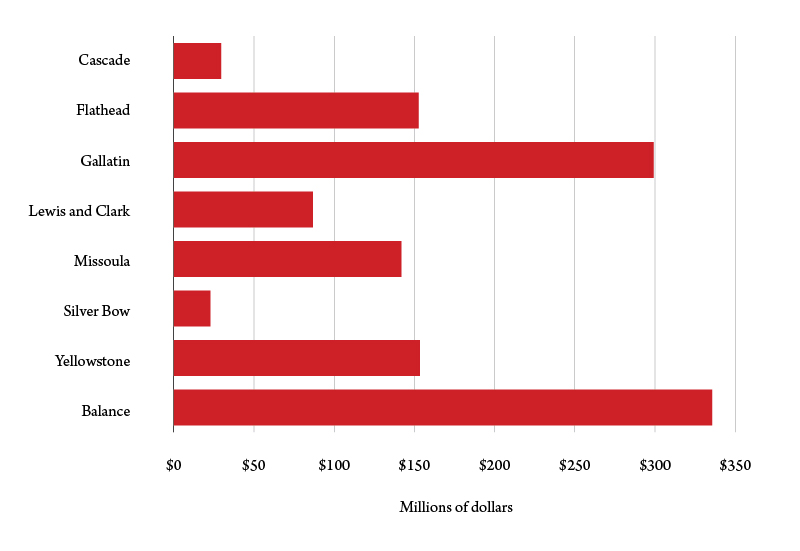

Tracking economic growth in terms of total wages paid to payroll workers, inflation-corrected, shows the differences in growth in the current economic recovery between the state’s most populous counties, as well as the balance of the state. Since the latest data extend only to the second quarter of 2021, the growth shown in Figure 1 refers to the changes of fiscal year 2021 (July 2020-June 2021) compared to the previous fiscal year.

Gallatin County in southwest Montana adjacent to Yellowstone National Park continued to pace statewide growth, adding almost $300 million in wages in 2021. But $335 million in wage gains, more than a quarter of total state growth, occurred outside the largest seven counties in the state. Missoula and Flathead counties were in the next tier of growth as in past years, but 2021 saw considerable improvement in total wage growth in Yellowstone County, the state’s largest economy. Also notable was an uptick in Lewis and Clark County growth that was indirectly due to the heavy levels of national economic spending that expanded the role of state government during the pandemic.

Gallatin County Continues to Surge

Much was made of the U.S. Census announcement that the population in Gallatin County had overtaken Missoula County to become the state’s second largest. In terms of its economy, that event occurred at least three years ago. The state’s fastest growing county continued to pile up eye-watering growth statistics in 2021.

In just one sign of the pace of growth, third quarter 2021 enplanements at Bozeman Yellowstone International Airport were up by 90% from pre-COVID 2019 levels, the second fastest of all airports in the country. The facility recently completed a terminal expansion thought to be adequate for the next 10 years, but is now already planning more expansion.

The state’s fastest growing economy is being driven ahead by very strong growth in its professional services employers, where inflation-corrected total wages were up by more than $70 million. Most of these gains, as well as those in manufacturing, were high-tech related. Across the board growth resumed immediately after the COVID spring of 2020, with job gains of 15% since that time.

Growth has created problems as well, especially in housing and labor availability. Zillow reported median home values in Bozeman of $671,530, and realtors report listing prices of homes for sale well in excess of that.

The Next Growth Tier: Flathead, Missoula and Yellowstone Counties

In terms of recent growth, Flathead, Missoula and Yellowstone counties have in common growth of around $150 million in total wages in the most recent fiscal year, but the drivers of that growth and their economic mix overall are quite different.

As the smallest of the three counties, Flathead’s growth in percentage terms was fastest. Adjacent to Glacier National Park, the county was the recipient of considerable visitor spending in a busy tourist year. The booming real estate market in this high amenity part of the state was another important driver. Growth was broad-based, with manufacturing and transportation also producing sizable gains.

Missoula County has seen faster growth since 2018, mostly due to growth related to high-tech. But 2021 growth came from strong rebounds in retail sales and health care, two segments of its economy that serve the broader region. Retail growth was dominated by building materials stores and vehicle dealers. Missoula also had a higher benefit from COVID-related government spending than other parts of the state.

Yellowstone County has grown slower than the state average for a number of years, due to the slowdown in oil and gas production activity and the weakness in the four-state region, which it serves as the economic hub. Similar to Missoula, its retail trade and health care businesses helped propel faster growth in 2021, even as its mining support and manufacturers (primarily its three oil refineries) turned in subpar performances.

Completing the List: Cascade, Lewis and Clark, and Silver Bow Counties

In past years, lower rates of population in-migration and a lower presence in faster growing professional services industries has produced slower growth in Cascade (Great Falls), Lewis and Clark (Helena) and Silver Bow (Butte) counties. That story changed this year in Lewis and Clark County with the surge of federal spending helping raise total wages in the state’s capital region by $87 million in 2021. Past growth from new facilities, such as Boeing, fell back, while health care, as in so many other parts of the state, saw good growth.

Cascade County’s total wage growth of just under $30 million in 2021 had a bit more headwind, with declines in information (media), accommodations and food and professional business services more than offset by gains in construction, health care and government. The announcement of the new medical school in Great Falls holds some promise for gains going forward, while the challenges for Montana agriculture weigh more heavily on this urban area.

Butte-Silver Bow’s modest growth in total wages hides stronger up and down movements in individually important industries. These include the utilities industry (mostly NorthWestern Energy) and manufacturing, which nudged downward in 2021, offset by gains in retail, transportation, administrative support and health care.

The recent year was one in which some long standing differences in growth in jobs and wages across the different parts of the state resumed. The hole that was dug during the brief, but severe, recession of 2020 was deep, but growth last year made considerable progress to regain what was lost.