The lack of affordable housing has been an increasingly difficult problem for many Montana communities. With relatively few affordable homes available for households earning a low income, and with much of the existing affordable inventory aging and in need of rehabilitation, many households earning a low income are being priced out of housing markets.

When households become highly cost burdened they experience many difficulties in regard to health and well-being outcomes, such as educational attainment of minors, employment opportunities, etc. Those households priced completely out of the market experience the unending difficulties associated with homelessness. And it is not merely the cost-burdened household members who suffer, the difficulties of being cost-burdened or homeless extend from the individuals directly involved to the communities where they live. This imposes costs on community hospitals, schools, criminal justice efforts, infrastructure upkeep and many other community institutions. Reducing these costs will be an increasingly pressing problem moving forward.

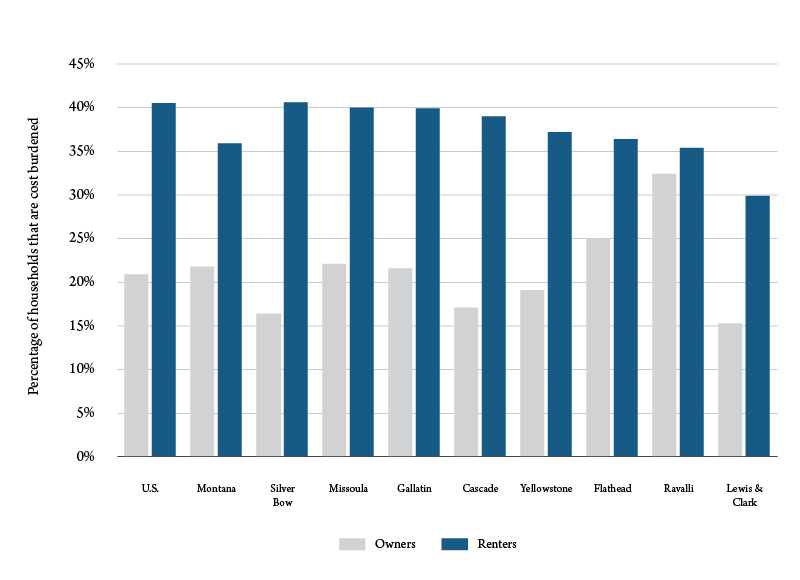

Figure 1 shows the extent of cost burden among renters and homeowners in various counties in Montana, and compares that to national and statewide averages.

Demand for affordable housing in Montana far outstrips supply. For example, statewide there are only 39 affordable housing units for every 100 households earning an extremely low income (below 30% of area median income). Since 2016, there have been over 30,000 applications for housing choice vouchers, with only about 4,000 issued. This indicates a demand-supply ratio of more than 7-to-1 for this program alone.

In order to understand the impacts of housing affordability challenges, it is helpful to consider the situation of complete unaffordability – homelessness. The costs borne by homeless individuals and families are stark and clearly visible. The instability caused by homelessness turns many basic necessities into near impossibilities. Finding adequate food, shelter, clothing, washing facilities, transportation, health care, education, personal safety and security, and employment become highly time-intensive and often impossible. These challenges are compounded by the high levels of substance abuse and mental illness experienced by homeless individuals and families.

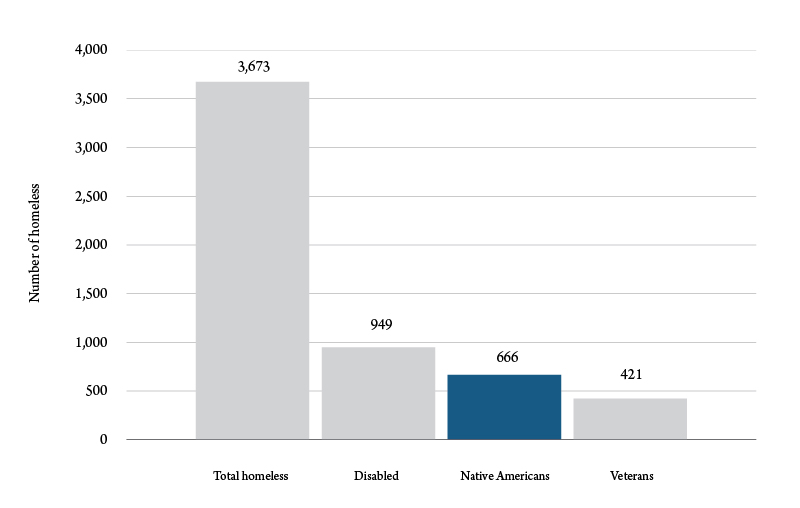

Figure 2 shows an estimate of the number of individuals experiencing homelessness in Montana. The proportion of Native Americans experiencing homelessness in Montana is noteworthy. It is estimated that Native Americans make up 6.5% of the population of Montana, yet individuals identifying as Native American make up 18% of the total homeless population. This constitutes an almost three times overrepresentation in the data.

Over the past several years affordable housing has become a nationwide concern. Prior to 2020, we had record lows in unemployment, record highs in the stock market, but troubling increases in income inequality. This had been a cause of growing concern, particularly in the area of housing where the cost of rent had been rising faster than wages in most areas of the United States. The year 2020 exacerbated these concerns by adding record unemployment claims and record business closures, on top of continuously rising housing costs.

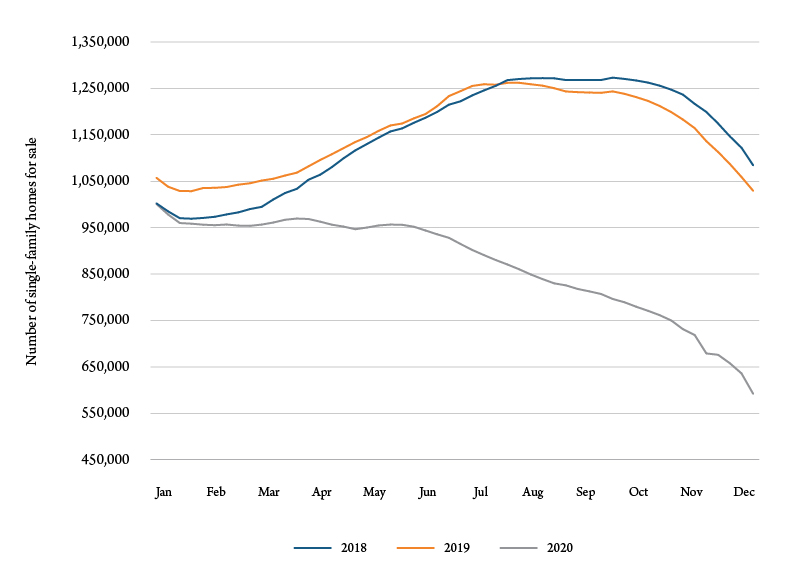

As with any market, housing prices are influenced by supply and demand factors. The current boom in home prices is no different. One of the starkest factors driving this trend is the lack of available housing supply in the United States. Figure 3 illustrates this phenomenon by showing the number of single-family homes available for sale throughout the calendar year in the U.S. for the years 2018-20. We see that historically there have been roughly 1 million homes for sale at the beginning of the calendar year. This number tends to rise through the spring and early summer, peak in late summer, and fall back to around 1 million by the end of the calendar year.

We see in Figure 3 that 2020 was a major deviation from this trend. While the year started with the same number of homes for sale as in previous years, the housing inventory did not rise through the spring, and started falling precipitously through the summer and fall. The available supply of single-family homes for sale at the end of 2020 was little more than half of the inventory at the beginning of the year. As of January 2021, there were less than 576,000 available single-family homes for sale across the country.

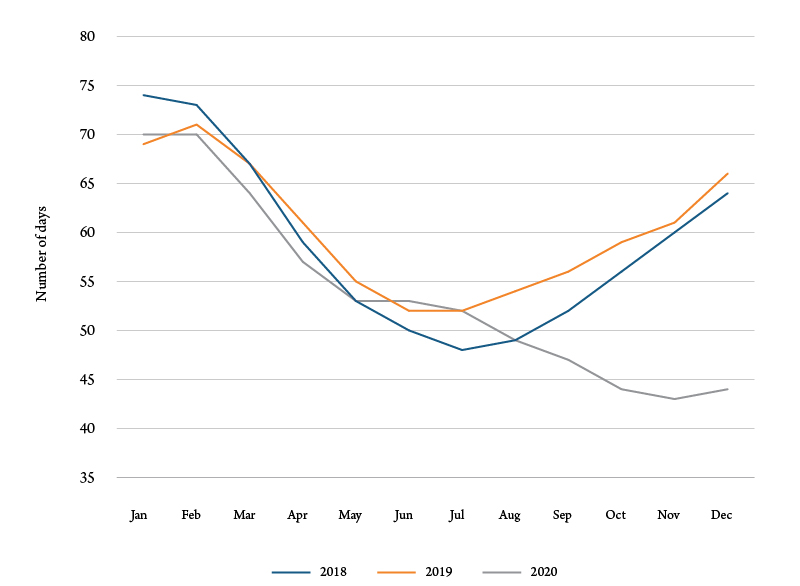

The demand side is also driving the recent housing market boom. Figure 4 shows the average number of days a home is on the market before a sale is pending throughout the calendar year for the years 2018-20. Again, we can see a clear 2020 deviation in buyer behavior from previous years. We have vastly fewer homes for sale nationwide, and buyers are acting fast to make deals.

Communities are economically stronger, and are able to offer a shared, higher quality of life when there are employment opportunities for all who seek jobs and a variety of homes available for renting or buying. In situations like this, almost every household can find the home that fits their needs and their budget. In these communities, children are able to focus on school instead of the stress of homelessness, there are fewer or no food-insecure families, people can spend more time focusing on their own health, and people are able to plan and save for their retirement.

The United States as a whole is currently facing a shortage of affordable homes, and Montana is no exception. With relatively few affordable homes available for households earning a low income, and with much of the existing affordable inventory aging and in need of rehabilitation, many households earning a low income are being priced out of housing markets. We are now facing ever expanding economic challenges, and these issues and concerns are not going away or getting better.

When housing becomes unaffordable, it imposes costs on entire communities, but the most vulnerable in society bear the brunt of those costs. Housing affordability will likely be a challenge that Montanans continue to face in the coming years, and as such it deserves a place in public conversation.