This November, Montanans will have the opportunity to vote on whether or not to legalize recreational marijuana. There are two items are on the ballot this election season. The first is CI-118, which amends the Montana Constitution to include language to establish the legal age for owning, consuming, and/or possessing marijuana; making it the same as for alcohol. The second ballot initiative is the Marijuana Legalization and Tax Initiative (I-190), which legalizes marijuana for consumption and possession of marijuana for adults over the age of 21.

If these ballot measures pass, Montana would join 11 states and the District of Columbia that have already legalized recreational marijuana. The list of other states wishing to fully legalize includes Arizona, New Jersey and South Dakota. South Dakota has two ballot measures: one to legalize medical and one to fully legalize recreational marijuana. Should the latter initiative pass, South Dakota will be the first state to move from fully illegal to fully legal, as it is not yet decriminalized. A further three states have medicinal cannabis on the ballot this year. Eight states have yet to decriminalize the legal use of marijuana for any purpose, including medicinal. In Oregon, there is a ballot initiative decriminalizes all drugs.

Montana is one of more than 30 states with legal medical marijuana, which became legal in 2004, when measure the Montana Medical Marijuana Act (I-148) passed. It was later amended in 2011 (SB 423) and 2016 (I-182). Currently, there are roughly 40,000 Montana residents with medical marijuana cards. These users consume roughly $18 million worth of cannabis products annually, generating $400,000 in tax revenues.

Changing Attitudes

According to a poll by the Pew Research Center, public attitudes toward marijuana legalization have changed dramatically since the turn of the century. In 2000, approximately 63% of surveyed Americans believed recreational marijuana should be illegal. By 2019, the most recent poll, that percentage had flipped. Now, about 67% of Americans believe cannabis should be legal.

In Montana, a 2017 survey conducted by the Montana Department of Public Health and Human Services found that less than half of Montanans believed recreational marijuana should be legal for adults. However, the University of Montana’s spring 2020 Big Sky Survey found that 54% believed that recreational marijuana should be legal, compared to 37% who did not.

While the positive respondents in the Pew Research Center’s national poll tilted to the left, 78% saying it should be legal, 55% of right-of-center respondents also favored legalization. They also found a person’s education level does not impact their beliefs – all education levels from high school or less, to post-graduate degrees fell in the 63% to 68% range. Millennials favored legalizing marijuana (76%) with support from both Republicans (71%) and Democrats (78%). Only the silent generation disapproved with 64% saying no.

Economics

The most fundamental tool economists reach for to determine the efficacy or cost of any given decision, whether it be a policy or household decision, is a cost-benefit analysis. If the cost is greater than the benefit, then the policy/decision should be abandoned. Of course, this simple calculation is complicated by a decision having an impact over time and by uncertainty. Also problematic is how and what should be measured to perform the necessary analysis.

As with other economic decisions, there are costs and benefits of legalizing recreational marijuana, which for our purposes will be cannabis – that includes the intoxicating compound THC. Like other drugs and alcohol, there are costs with marijuana from physical and mental health issues, to lost productivity to legal and enforcement costs. Also the probability of being involved in an automobile crash, compared to drivers with no evidence of marijuana use, is about 25% higher. However other factors, such as age, time of day, and other drugs and alcohol, may account for the increased crash risk.

These are undoubtedly real costs, but let’s put them in context beginning with health, and more specifically the leading causes of death in the United States. A study in the Journal of the American Medical Association (2004) verified the leading causes of death in the U.S. were heart disease, diabetes, accidents and cancer. But the study took the analysis a step further by relating the leading causes of death to the actual causes of death. To put it another way, what led up to the death?

The leading killers are tobacco (18%), and poor diet and physical activity (16.6%). Alcohol was a distant third at 3.5% and vehicle crashes accounted for 1.8%. According to the National Highway Traffic Safety Administration, alcohol was involved in 28% of vehicle fatalities at a cost of $44 billion in 2010.

Illicit drug use accounted for 0.7%, right behind sexual behavior (0.8%). Deaths associated with drug use included all illegal drugs, mental and physical health, violence and accidents. The authors concluded that roughly half of all deaths in the U.S. could be attributed to behavioral choices – one-third of preventable deaths can be attributed to cigarettes, and diet and exercise alone.

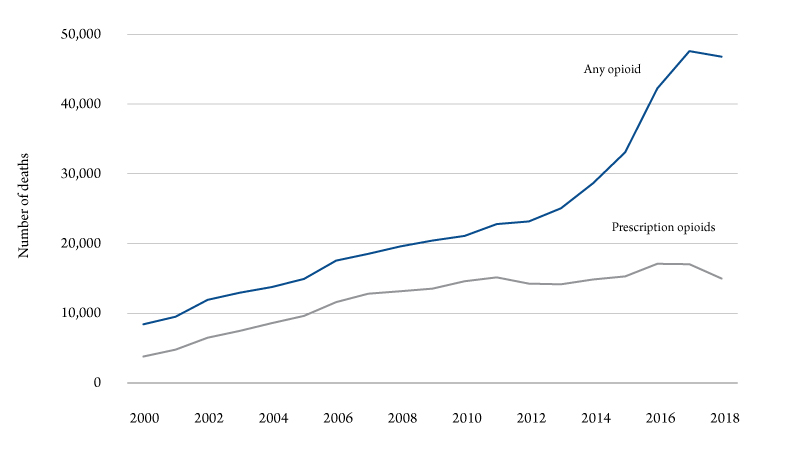

This research was conducted before the frightening escalation of opioids, legal and otherwise, which accelerated deaths after the Great Recession. Figure 1 shows the number of opioid related overdose deaths in the United States. Prescription deaths rose until 2010, and have stabilized since. But non-prescription deaths have been on the rise since 2010, with some leveling off since 2016. Research on the economic costs of prescription opioid use in 2013 was figured to be about $78.5 billion.

Similarly, research shows the economic cost of cigarettes to be in the $320 billion range. Direct health costs account for $170 billion and $156 billion is associated with lost productivity. Of the lost productivity, secondhand smoke adds about $6 billion to the tally.

From an economic perspective, we can use taxes to help internalize the external costs. If the tax revenues generated by sales of cigarettes are used to finance the health costs of smokers, then cigarette consumers contribute to the full cost of their behavior. In 2019, sin taxes for alcohol, tobacco and gambling contributed about $85.5 million (about 3%) to Montana’s general fund.

Another cost of illegal marijuana is the substantial social and economic cost of incarceration and enforcement. Since its launch in 1971 by former President Richard Nixon, the war on drugs has cost American taxpayers over $1 trillion. The federal government spends almost $10 million per day on drug related incarceration and states spend roughly $70 billion per year.

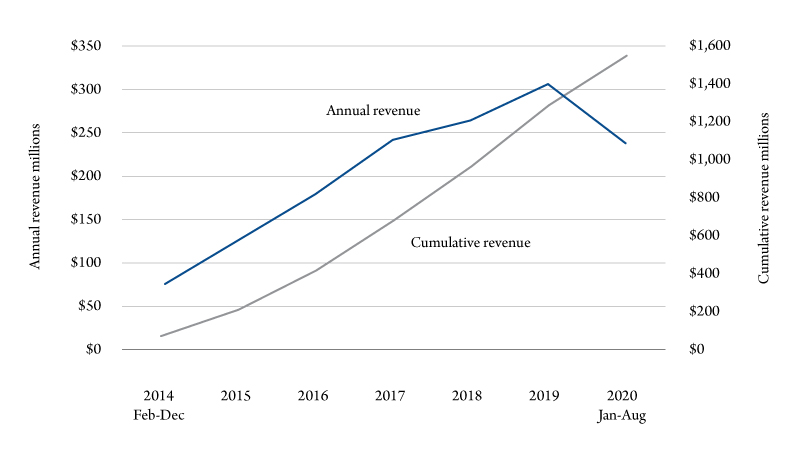

One incentive for Montana to consider from the revenue side of recreational marijuana is the experience Colorado has had since legalization in 2014. In mid-2019, Colorado passed the $1 billion tax revenue milestone (Figure 2). While it is unlikely that Montana will see that level of success, legalizing could recapture some lost tax revenues from Montanans who travel to legal states and tourists who chose to vacation elsewhere.

A recent study completed by the Bureau of Business and Economic Research found that legalizing recreational marijuana could contribute an additional $43 million to Montana’s general fund in 2022, increasing sin tax revenues by 50%. Given the current economic environment, with slowing household income and increases in transfer payments, a new revenue stream could help reduce red ink.

As a cautionary note, there is some evidence suggesting that cannabis tax revenues might not be the panacea several states predicted. Both Massachusetts and California, which have legalized recreational marijuana, fell substantially short of their revenue projections in the first year. As more states legalize both recreational and medical marijuana, the monopoly power enjoyed by states like Colorado and Washington is being watered down.

On the spending side, Montana initiative I-180 dictates that 10.5% of the recreational cannabis tax revenue go to the state general fund. The remaining revenues are dispersed to accounts for conservation programs, substance abuse treatment, veterans services, health care costs and localities where marijuana is sold.

While we do not support nor oppose the legislation, the general consensus seems to be that the costs of criminalizing cannabis outweigh its benefits. Clearly, marijuana legalization has some growing pains. Fortunately, if Montanans choose to legalize recreational marijuana this year, the state can walk in the footsteps of others and learn from their costly mistakes while improving upon their successes.

References

Daniller, Andrew. Two-Thirds of Americans Support Marijuana Legalization, FactTank: News in the Numbers, Pew Research Center, November 2020. (https://www.pewresearch.org/fact-tank/2019/11/14/americans-support-marijuana-legalization/)

University of Montana, Big Sky Poll, February 2020.

National Highway Traffic Safety Administration. Traffic Safety Facts 2016 Data: Alcohol-Impaired Driving. U.S. Department of Transportation, Washington, DC, 2017. (https://crashstats.nhtsa.dot.gov/Api/Public/ViewPublication/812450)

Blincoe L.J., Miller T.R., Zaloshnja E., Lawrence B.A. National Highway Traffic Safety Administration. The Economic and Societal Impact of Motor Vehicle Crashes. U.S. Department of Transportation, Washington, D.C., 2015. (http://www-nrd.nhtsa.dot.gov/pubs/812013.pdf)

Compton R.P., Berning A. National Highway Traffic Safety Administration. Traffic Safety Facts: Research Note, Drugs and Alcohol Crash Risk, U.S. Department of Transportation, Washington, D.C., 2015. (http://www.nhtsa.gov/staticfiles/nti/pdf/812117-Drug_and_Alcohol_Crash_Risk.pdf)

Florence C.S., Zhou C., Luo F., Xu L. The Economic Burden of Prescription Opioid Overdose, Abuse, and Dependence in the United States, 2013. Med Care. 2016; 54: 901-906.

U.S. Department of Health and Human Services. The Health Consequences of Smoking – 50 Years of Progress: A Report of the Surgeon General. Atlanta: U.S. Department of Health and Human Services, Centers for Disease Control and Prevention, National Center for Chronic Disease Prevention and Health Promotion, Office on Smoking and Health, 2014.

Xu X, Bishop E.E., Kennedy S.M., Simpson S.A., Pechacek T.F. Annual Healthcare Spending Attributable to Cigarette Smoking: An Update. American Journal of Preventive Medicine 2014; 48(3): 326–33.

Pletcher et al. Association Between Marijuana Exposure and Pulmonary Function Over 20 Years, Journal of the American Medical Association. 2012; 307(2):173-181.